Retail in South Africa

In this paper we highlight the puzzle of why certain practises in developing and developed retail markets seem to be converging, despite these markets differing strongly in their underlying consumer bases (demographics, median income, etc.). We look at the case of South Africa, where the percentage-of-basket of private label brands appears to be converging with that of developed markets, and where South Africa is experiencing the fastest growth in demand for green consumption. In terms of demand for private label brands, we argue that while the proportion of middle-class consumers is lower compared to that of developed nations, and despite much of South Africa's retail taking place in the informal sector, the growth rate of South Africa’s middle-class is immense. This, and the rapid adoption of product labelling legislation, has incentivised retailers with integrated supply chains to further develop their product strategy, to better exploit their position, resulting in the increased adoption of private label brands. Unique challenges and responses by competitors are discussed. [Andrew Montandon. European Retail Research, 2014] [Link]

Consumers willing to pay more for sustainable goods converging around 40-50% in 2013.

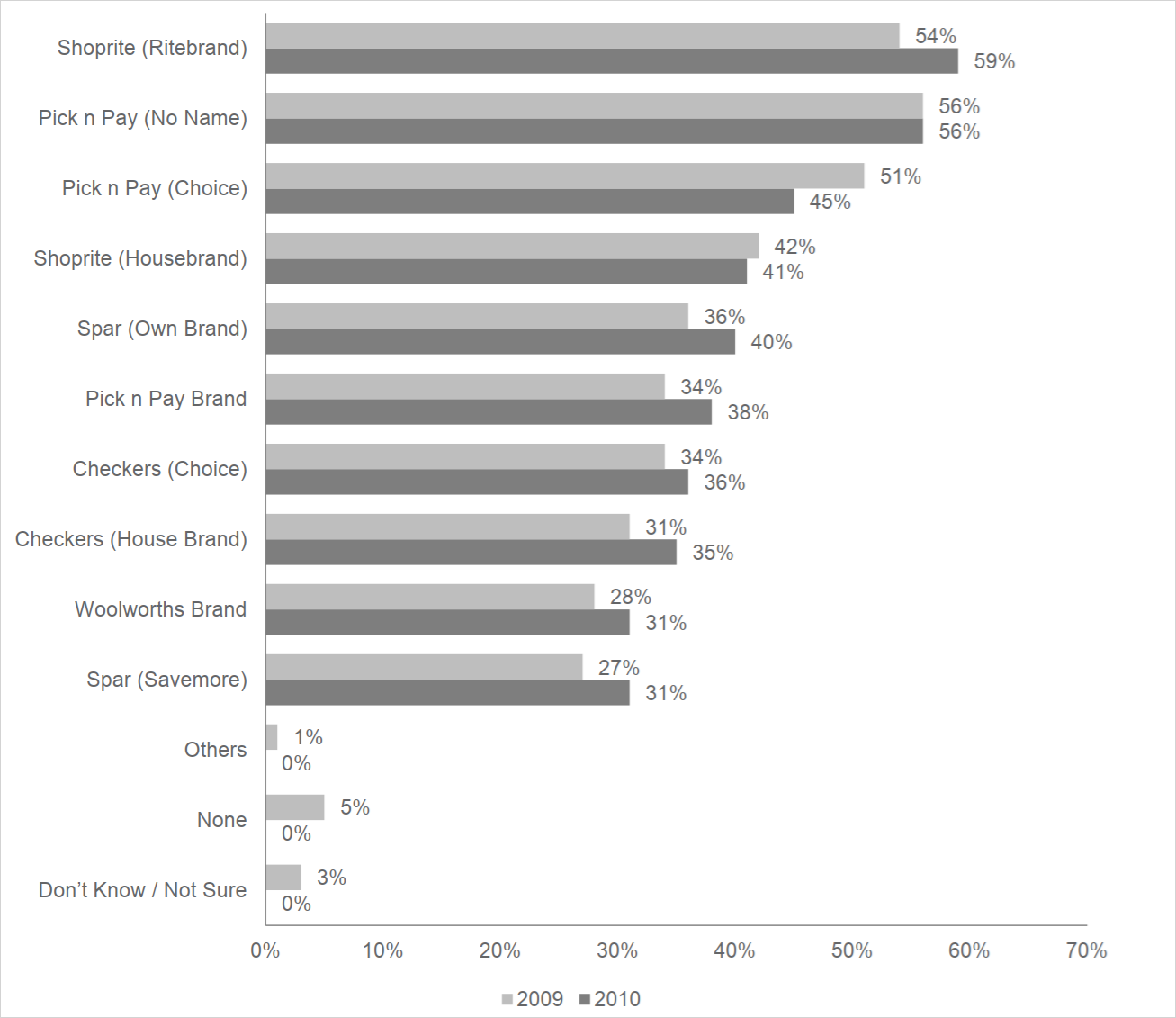

Awareness of private label brands in South Africa increases year-on-year by 2.5%.